Futures returns consist of two components: the returns of the spot price and the "roll returns". This is kind of obvious if you think about it: suppose the spot price remains constant in time (and therefore has zero return). Futures with different maturities will still have different prices at any point in time, and yet they must all converge to the same spot price at expirations, which means they must have non-zero returns during their lifetimes. This roll return is in action every day, not just during the rollover to the next nearest contract. For some futures, the magnitude of this roll return can be very large: it averages about -50% annualized for VX, the volatility futures. Wouldn't it be nice if we can somehow extract this return?

In theory, extracting this return should be easy: if a future is in backwardation (positive roll return), just buy the future and short the underlying asset, and vice versa if it is in contango. Unfortunately, shorting, or even buying, an underlying asset is not easy. Except for precious metals, most commodity ETFs that hold "commodities" actually hold only their futures (e.g. USO, UNG, ...), so they are of no help at all in this arbitrage strategy. Meanwhile, it is also a bit inconvenient for us to go out and buy a few oil tankers ourselves.

But in arbitrage trading, we often do not need an exact arbitrage relationship: a statistical likely relationship is good enough. So instead of using a commodity ETF as a hedge against the future, we can use a commodity-producer ETF. For example, instead of using USO as a hedge, we can use XLE, the energy sector ETF that holds energy producing companies. These ETFs should have a higher degree of correlation with the spot price than do the futures, and therefore very suitable as hedges. In cases where the futures do not track commodities (as in the case of VX), however, we have to look harder to find the proper hedge.

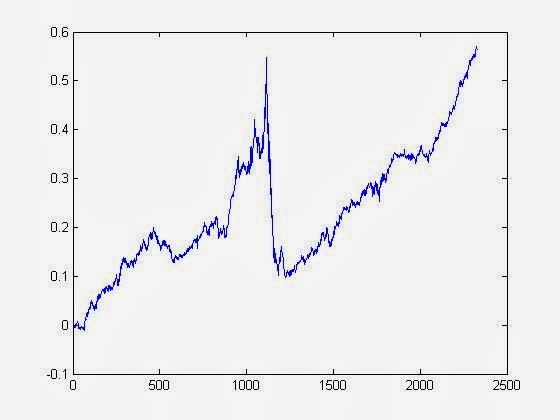

Which brings me to this fresh-off-the-press paper by David Simon and Jim Campasano. (Hat tip: Simon T.) This paper suggests a trading strategy that tries to extract the very juicy roll returns of VX. The hedge they suggest is -- you guessed it! -- the ES future. In a nutshell: if VX is in contango (which is most of the time), just short both VX and ES, and vice versa if VX is in backwardation.

Why does ES work as a good hedge? Of course, its very negative correlation with VX is the major factor. But one should not overlook the fact that ES also has a very small roll return (about +1.5% annualized). In other words, if you want to find a future to act as a hedge, look for ones that have an insignificant roll return. (Of course, if we can find a future that has high correlation with your original future but which has a high roll return of the opposite sign, that would be ideal. But we are seldom that lucky.)

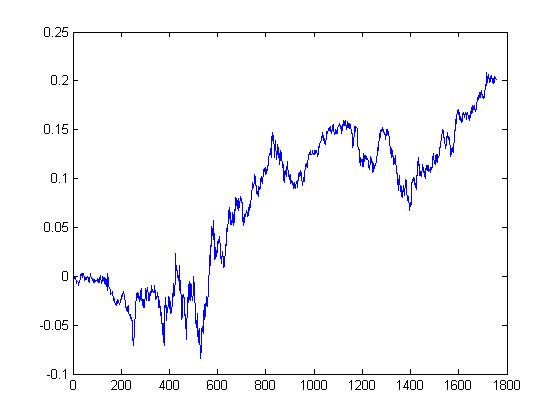

P.S. The reader Simon who referred me to this paper also drew my attention to an apparent contradiction between its conclusion and my earlier blog post: Shorting the VIX Calendar Spread. This paper says that it is profitable to short VX when it is in contango and hedge with short ES, while I said it may not be profitable to short the front contract of VX when it is in contango and hedge with long back contract of VX. Both statements are true: hedging with the back contract of VX brings very little benefit because both the front and back contracts are suffering from very similar roll returns, so there is little return left when you take opposite positions in them!

In theory, extracting this return should be easy: if a future is in backwardation (positive roll return), just buy the future and short the underlying asset, and vice versa if it is in contango. Unfortunately, shorting, or even buying, an underlying asset is not easy. Except for precious metals, most commodity ETFs that hold "commodities" actually hold only their futures (e.g. USO, UNG, ...), so they are of no help at all in this arbitrage strategy. Meanwhile, it is also a bit inconvenient for us to go out and buy a few oil tankers ourselves.

But in arbitrage trading, we often do not need an exact arbitrage relationship: a statistical likely relationship is good enough. So instead of using a commodity ETF as a hedge against the future, we can use a commodity-producer ETF. For example, instead of using USO as a hedge, we can use XLE, the energy sector ETF that holds energy producing companies. These ETFs should have a higher degree of correlation with the spot price than do the futures, and therefore very suitable as hedges. In cases where the futures do not track commodities (as in the case of VX), however, we have to look harder to find the proper hedge.

Which brings me to this fresh-off-the-press paper by David Simon and Jim Campasano. (Hat tip: Simon T.) This paper suggests a trading strategy that tries to extract the very juicy roll returns of VX. The hedge they suggest is -- you guessed it! -- the ES future. In a nutshell: if VX is in contango (which is most of the time), just short both VX and ES, and vice versa if VX is in backwardation.

Why does ES work as a good hedge? Of course, its very negative correlation with VX is the major factor. But one should not overlook the fact that ES also has a very small roll return (about +1.5% annualized). In other words, if you want to find a future to act as a hedge, look for ones that have an insignificant roll return. (Of course, if we can find a future that has high correlation with your original future but which has a high roll return of the opposite sign, that would be ideal. But we are seldom that lucky.)

P.S. The reader Simon who referred me to this paper also drew my attention to an apparent contradiction between its conclusion and my earlier blog post: Shorting the VIX Calendar Spread. This paper says that it is profitable to short VX when it is in contango and hedge with short ES, while I said it may not be profitable to short the front contract of VX when it is in contango and hedge with long back contract of VX. Both statements are true: hedging with the back contract of VX brings very little benefit because both the front and back contracts are suffering from very similar roll returns, so there is little return left when you take opposite positions in them!